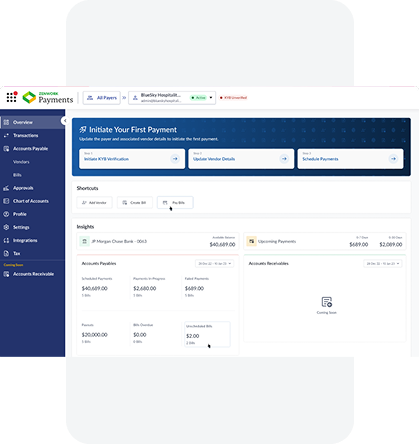

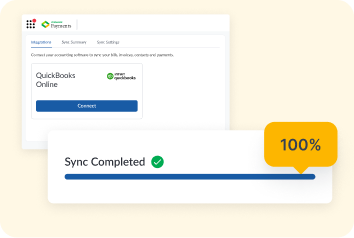

Your Data

Always Up to Date

Bills, vendors, and payments synced automatically.

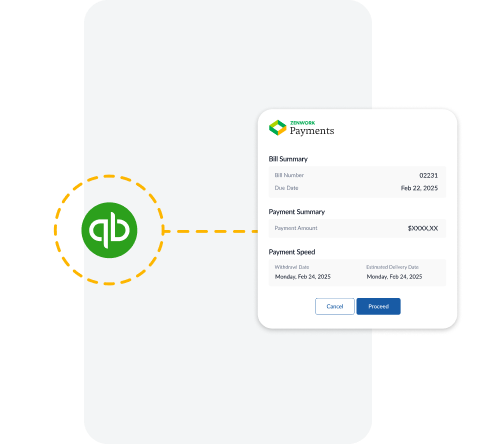

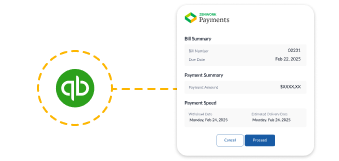

Bill import

Zenwork Payments pulls unpaid bills from QuickBooks Online, so you can review, approve, and pay them without manual entry.

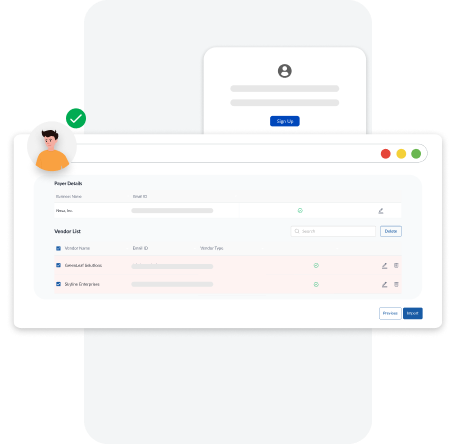

Vendor details

Zenwork Payments imports vendor information, ensuring payments and tax records stay accurate.

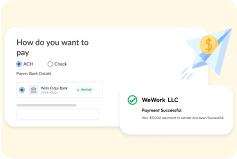

Payment status

Once bills are paid in Zenwork Payments, QuickBooks Online is automatically updated with the payment details, keeping your books in sync.