Zenwork Payments vs Tipalti

|

|

|

|---|---|---|

| Pricing model |

Simple subscription + per-vendor fee. No seat fees,

unlimited users, and EINs. Simple subscription + per-vendor fee. No seat fees,

unlimited users, and EINs.

|

Tiered SaaS subscription with platform-based pricing and usage-based components. |

| Starting cost |

$19.99/month. Includes QuickBooks Online / QuickBooks

Desktop sync, approvals, W-9 e-sign, real-time TIN match, and auto-draft 1099-NEC/MISC. $19.99/month. Includes QuickBooks Online / QuickBooks

Desktop sync, approvals, W-9 e-sign, real-time TIN match, and auto-draft 1099-NEC/MISC.

|

Packaged plans (Select, Advanced, Elevate) with pricing that scales by tier and feature set. |

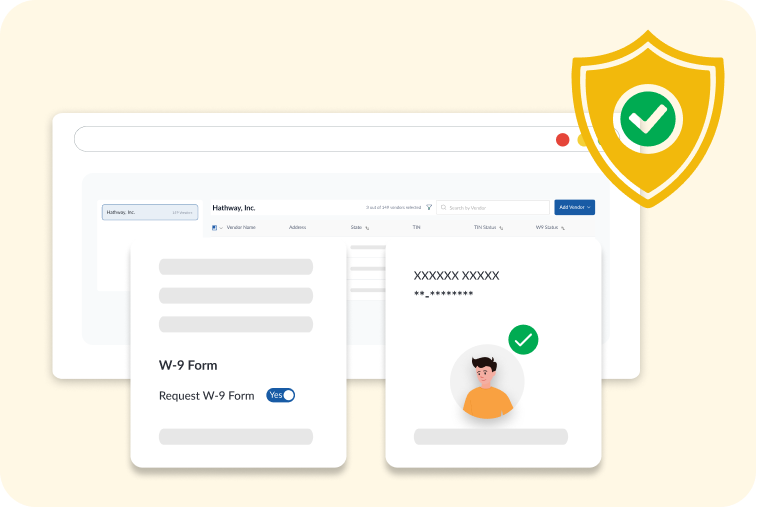

| Core compliance |

W-9 collection with real-time TIN verification and

integrated 1099 e-filing. W-9 collection with real-time TIN verification and

integrated 1099 e-filing.

|

W-9 collection and TIN validation embedded into the payable’s workflow. |

| Tax workflow focus |

Focused around U.S. information reporting with automated

1099 NEC/MISC preparation and e-filing. Focused around U.S. information reporting with automated

1099 NEC/MISC preparation and e-filing.

|

Supports U.S. tax requirements as part of a broader global tax and compliance framework. |

| Invoice capture |

Intelligent OCR from email/upload to capture invoice data

and prepare it for coding and approval. Intelligent OCR from email/upload to capture invoice data

and prepare it for coding and approval.

|

OCR-based invoice capture with automated extraction of key invoice details. |

| Bill management & approvals |

Bill creation and routing them through configurable

approval workflows. Bill creation and routing them through configurable

approval workflows.

|

Bill entry and routing through flexible approval rules and controls. |

| User & role management |

Customizable approval roles and role-based access

controls, with no limit on internal users. Customizable approval roles and role-based access

controls, with no limit on internal users.

|

Unlimited internal users with configurable approval roles and permissions. |

| Accounting & ERP sync |

Two-way sync with major accounting systems such as

QuickBooks, plus multi-entity support. Two-way sync with major accounting systems such as

QuickBooks, plus multi-entity support.

|

Integration to leading accounting and ERP platforms, including mid-market and enterprise systems. |

| Vendor experience |

Self-service vendor portal with branded onboarding,

automatic W-9 collection, compliance checks, payment preferences, and 1099 form access. Self-service vendor portal with branded onboarding,

automatic W-9 collection, compliance checks, payment preferences, and 1099 form access.

|

Self-service portal for secure onboarding, tax form collection, payment preferences, and access to 1099 forms. |

60%

60% 49%

49%